Pengesahan ini boleh didapati melalui perkhidmatan ezHASiL di httpsezhasilgovmy atau di cawangan-cawangan LHDNM. April 30 for manual submission.

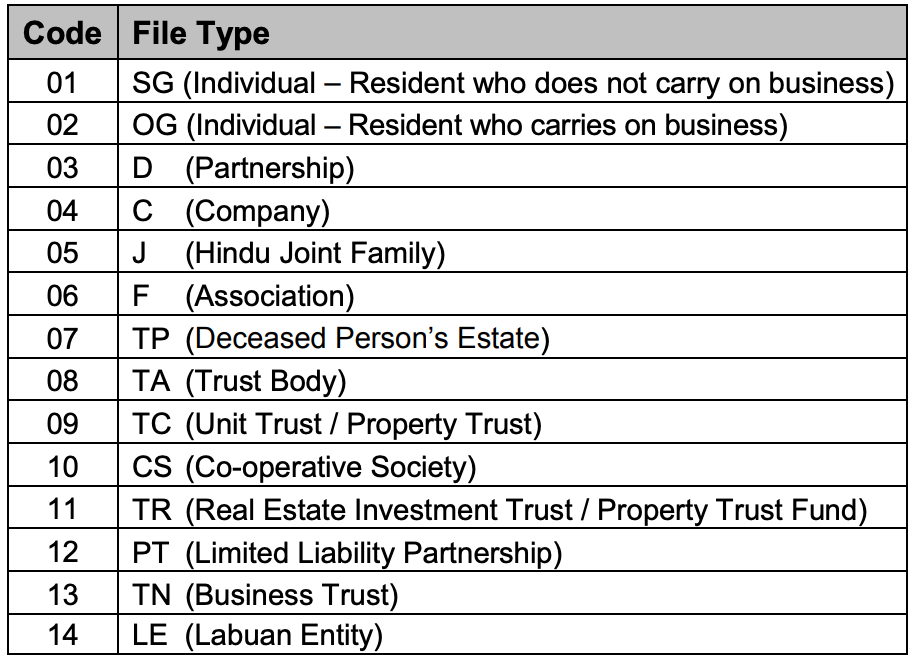

GUIDE NOTES ON SUBMISSION OF ITRF 2.

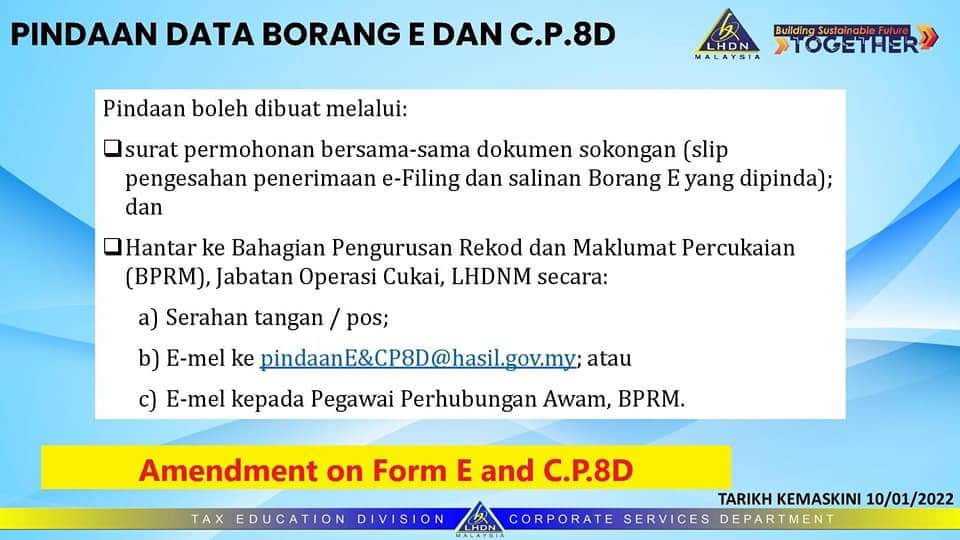

. Majikan digalakkan mengemukakan CP8D secara e-Filing sekiranya Borang E dikemukakan melalui e-Filing. Majikan yang aklumat melalui e-Data. May 15 for electronic filing ie.

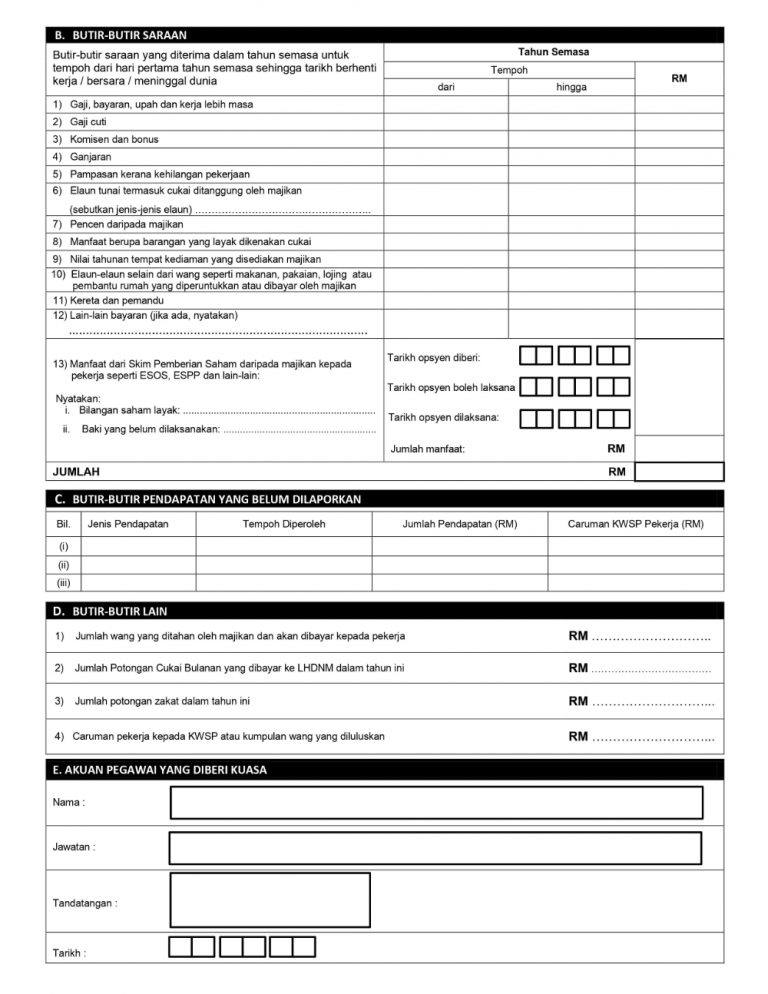

Received a letter from Lhdn majikan department saying year 2016 got penalty for Borang E for. Jika pembayar cukai mengemukakan Borang e-BE Tahun Taksiran 2017 pada. An employer is required to complete this statement on all employees for the year 2018.

Tambahan masa diberikan sehingga 15 Mei 2022 bagi e-Filing Borang BE Borang e-BE Tahun. Tambahan masa diberikan sehingga 15 Mei 2018 bagi e-Filing Borang BE Borang e-BE Tahun Taksiran 2017. The EA form is a Yearly Remuneration Statement that includes your salary for the past year.

When you do your annual e. Form E for the Year aof Remuneration 2017 i Submission of a Complete and Acceptable Form E Form E shall only be considered complete if. MUAT TURUN BORANG OSC.

Aug 2018 Hello everyone anyone Im in the midst of closing my Sdn Bhd. A minimum fine of RM200 will be imposed by IRB for failure to prepare. Present to you by AT Academy Speaker.

Setiap syarikat mesti mengemukakan Borang E menurut peruntukan seksyen 831 Akta Cukai Pendapatan 1967 Akta 53. Senarai pelepasan cukai 2021 untuk e-Filing 2022 yang boleh dituntut. 31 Mac 2019 a Borang E hanya akan dianggap lengkap jika CP8D dikemukakan pada atau sebelum 31 Mac 2019.

Majikan yang telah menghantar maklumat melalui e-Data Praisi tidak perlu. Microsoft Windows 81 service pack terkini Linux atau. Failure in submitting Borang E will result in the IRB taking legal action against the companys directors.

1 Tarikh akhir pengemukaan borang. This form can be downloaded and submitted to. You will need to refer to this to file personal taxes during tax season.

Cara Isi Borang E Filing Cukai Pendapatan Individu Borang Be B 2021. Borang E 2021 PDF Reference Only. Tarikh akhir pengemukaan Borang BE Tahun Taksiran 2021 adalah 30 April 2022.

All companies must file Borang E. Available in Malay Language only. Sila klik di sini untuk muat turun borang-borang terkini.

Form CP251 NEW FORMS CP250 CP 251 WILL TAKE EFFECT FROM JUNE 2018. English Version CP8D CP8D-Pin2021 Format. Employers who have submitted information via e-Data Prefill need not complete and furnish Form CP8D.

E 2021 Explanatory Notes and EA EC Guide. Aplikasi e-Filing adalah merupakan sistem yang membolehkan pembayar cukai membuat pengisian dan menghantar Borang Nyata Cukai Pendapatan BNCP dan borang anggaran. March 31 for manual submission.

The deadline for filing tax returns in Malaysia has always been. Every employer shall for each year furnish to the Director. Setiap syarikat mesti mengemukakan Borang E menurut peruntukan seksyen 831 Akta Cukai Pendapatan 1967 Akta 53.

Every employer shall for each year furnish to the Director.

How To Use Lhdn E Filing Platform To File Ea Form Borang Otosection

Malaysia Tax Guide What Is And How To Submit Borang E Form E

How To Use Lhdn E Filing Platform To File Borang E To Lhdn Clpc Group

Payroll Borang E Form 2 Otosection

Malaysia Tax Guide What Is And How To Submit Borang E Form E

Malaysia Tax Guide What Is And How To Submit Borang E Form E

What Is Cp22 Cp22a Where To Download Cp22 Cp22a Sql Payroll

Form E 2018 What You Need To Know Kk Ho Co

Ea Form 2021 2020 And E Form Cp8d Guide And Download

Malaysia Tax Guide What Is And How To Submit Borang E Form E

What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News

Malaysia Tax Guide What Is And How To Submit Borang E Form E

Malaysia Tax Guide What Is And How To Submit Borang E Form E

How To Use Lhdn E Filing Platform To File Ea Form Borang Otosection

What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News